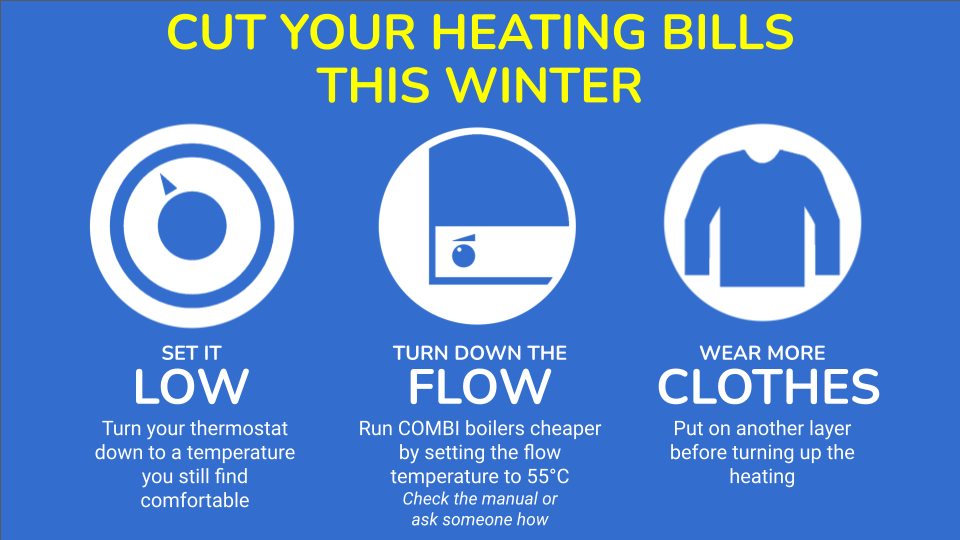

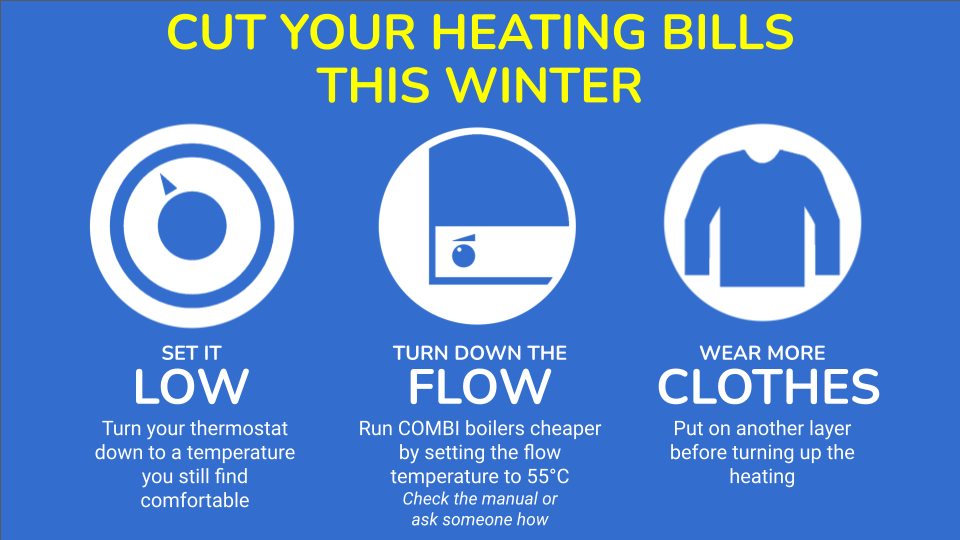

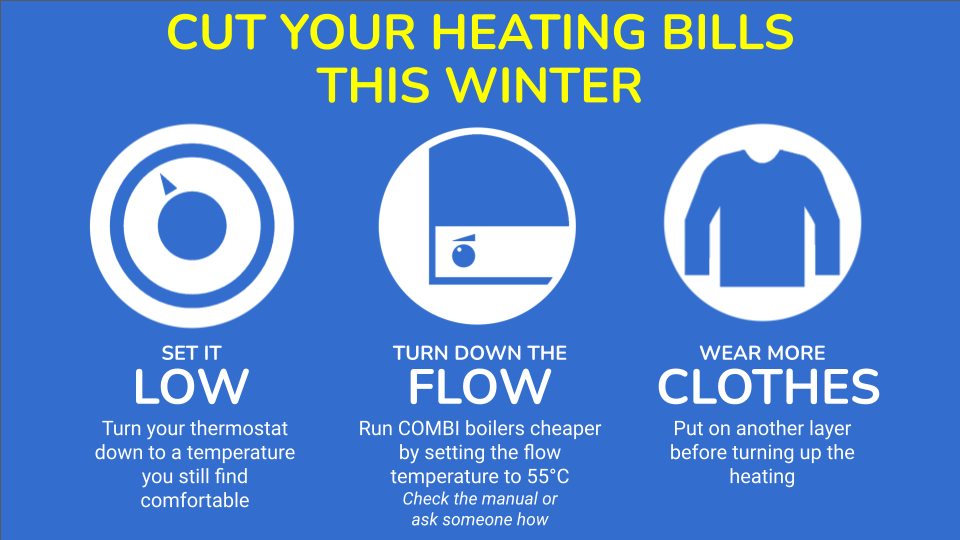

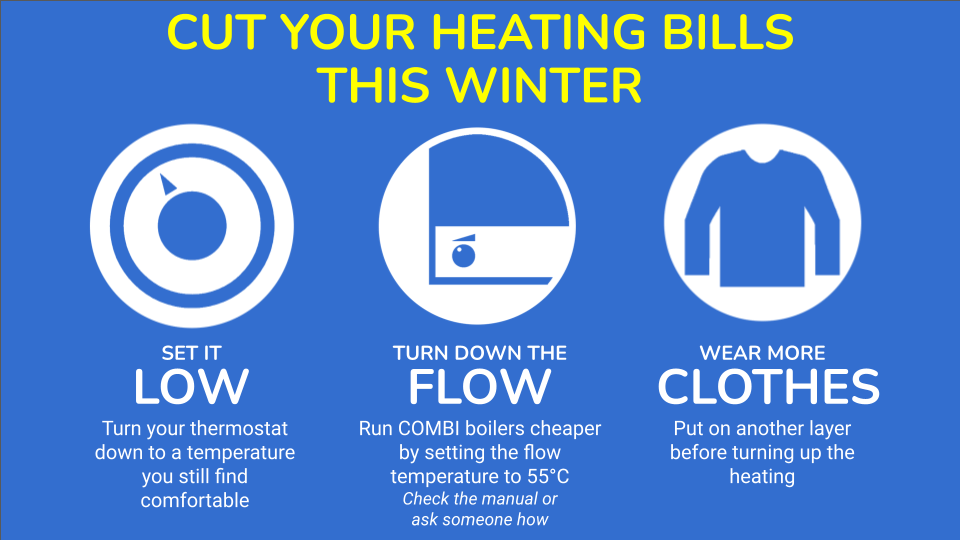

Gaming your Heating for Cash and Giggles! - Learn just these three simple money-saving tricks that can make you slimmer and richer! :) #OperationTuneup #cash #climate - https://www.earth.org.uk/Gaming-Heating-For-Profit-and-Laughs.html

Gaming your Heating for Cash and Giggles! - Learn just these three simple money-saving tricks that can make you slimmer and richer! :) #OperationTuneup #cash #climate - https://www.earth.org.uk/Gaming-Heating-For-Profit-and-Laughs.html

Zelensky: Future American Arms Transfers to Ukraine Will Be Only for Cash

https://www.kyivpost.com/post/49913

#Weapons #WarOfAggression #Europa #US #USA #America #Arms #Cash #Zelensky #Ukraine #army #update #Frontline #war #Russia #WarCriminal #occupiers #defenders

#перемогаYкраїни

https://www.europesays.com/1939026/ Anne Wojcicki Quits As 23andMe Files for Chapter 11 Bankruptcy #23andmeFile #alvarez #america #AnneWojcickiQuits #BANKRUPTCY #business #BusinessInsider #Cash #CEO #chapter #company #CourtSupervisedSaleProcess #datum #November #RecentMonth #staff #UnitedStates #UnitedStatesOfAmerica #US #USA #wojcicki

Ah, here it is, in the text of the report;

"The Bank of England and HM

Treasury note in their 2023 Consultation Paper that a digital pound would not be anonymous

because, 'just like bank accounts, the ability to identify and verify users is necessary to prevent

financial crime'.”

Chapter 2.1, Enhancing the Privacy

of a Digital Pound

https://dci.mit.edu/enhancing-the-privacy-of-a-digital-pound

So what they're contemplating is only as private as a bank transfer, not as private as cash.

U.S. #Treasury removed sanctions against the #crypto mixer service #Tornado #Cash

https://securityaffairs.com/175718/laws-and-regulations/u-s-treasury-removed-sanctions-tornado-cash.html

#securityaffairs #hacking

PS that's not to say that a small local #BarterEconomy can't have a useful place alongside our #cash and #card ones. It sure can. Perhaps we should look at how we can leverage the benefits of each, and in what circumstances what mechanism is most beneficial to us.

Supreme Court collegium begins process to transfer high court judge after recovery of cash stash from his house

THE SUPREME COURT collegium has initiated the process to transfer Delhi High Court judge Justice Yashwant Varma to the Allahabad High Court following the alleged recovery of a large stash of cash on March 14...

https://www.indiaweekly.biz/supreme-court-collegium-justice-yashwant-varma-cash-stash/

YES! As Reagan used to say: “It’s your money.” Don’t pay to spend your own meney! THIS!

https://infosec.exchange/@paco/114171915271973042

#money #cash #itsyourmoney

Quote of the morning coffee: "Norway’s former justice and emergencies minister Emilie Mehl put it in clear terms: “If no one pays with cash and no one accepts cash, cash will no longer be a real emergency solution once the crisis is upon us.”

i agree with this 100% & remind people

to PLEASE refuse to shop at places like Whole Foods that won't take cash... Bezos & the trackable society Is Not Your Friend

They are coming to enshittify money. Fight for cash. Don’t let them take it away.

Cash represents money that doesn’t cost money to use. It is a public good. All people can use cash There is no public good electronic transaction. (In the UK bank-to-bank transfers are free and easy by law. No reason to have Zelle or Venmo, not so in the US) We must protect cash.

Public libraries bother digital publishers because someone can read the book without paying for it. Cash bothers banks and big tech companies because you can spend it without paying them. Banks, credit card companies, and big tech (think ApplePay. SamsungPay, etc), want to charge you money for you to use your money. They also get transaction data that they can monetise in various ways (selling to you, selling the data, etc).

I experienced this last week. In the US it’s still free to deposit a paper check, but virtually any “wire” or electronic transfer has a fee. I signed a home equity line of credit and I was getting some proceeds. I had 2 options: “electronic check” or wire transfer. Wire transfer costs $20. “Electronic check” was free.

“Electronic check” is when they email me a PDF and I print it. Then, I take photographs of the printout with my bank’s mobile app for depositing checks. Takes more than a day to clear, but totally free.

Don’t let them take cash away. Fight for it. Use it some so people can see it being used.

#cash #cashless #money

https://www.theguardian.com/money/2025/mar/16/uk-high-street-chains-restaurants-cash-payments

Back to #cash: life without money in your pocket is not the utopia Sweden hoped https://www.theguardian.com/technology/2025/mar/16/sweden-cash-digital-payments-electronic-banking-security

Apparently the younger generations in #SouthKorea are using #Cash exclusively. Does anyone know of this? Is there such movements elsewhere that is as prevalent?

Gaming your Heating for Cash and Giggles! - Learn just these three simple money-saving tricks that can make you slimmer and richer! :) #OperationTuneup #cash #climate - https://m.earth.org.uk/Gaming-Heating-For-Profit-and-Laughs.html

Gaming your Heating for Cash and Giggles! - Learn just these three simple money-saving tricks that can make you slimmer and richer! :) #OperationTuneup #cash #climate - https://www.earth.org.uk/Gaming-Heating-For-Profit-and-Laughs.html