https://www.europesays.com/1999524/ Crude oil futures decline after IEA lowers demand forecast #CrudeOil #CrudeOilPrice #DemandForecast #futures #IEA #MCX #NaturalGas #NCDEX #OilMarket #OilPrice #petroleum #prices

Recent searches

Search options

#oilmarket

Oil Prices: OPEC+ Announcement Stuns Market https://www.bocvip.com/818032/oil-prices-opec-announcement-stuns-market/ #alliance #crude #DonaldTrump #energy #gas #iraq #Mining #oil #OilMarket #OilPrices #OilProduction #OPEC #OPECMembers #Russia #SaudiArabia #tariffs #trade #trading #trump #UsGovernment #UsPolitics

https://www.europesays.com/1922038/ Why OPEC+ is Supporting a Potentially Disastrous Rise in Oil Production #CrudeOil #CrudeOilPrice #oil #OilMarket #OilPrice #OilPrices #opec #OutputCuts #petroleum #Russia #SaudiArabia #Shale

https://www.europesays.com/1896970/ Restoring U.S. Oil Reserve to Capacity Could Take Years, Cost $20 Billion #CrudeOil #CrudeOilPrice #CrudeOilStorage #DOEBudget #EnergyPolicy #EnergySecurity #OilMarket #OilPrice #OilPrices #OilSupply #petroleum #SPRRefill #StrategicPetroleumReserve #TrumpEnergyPlan #U.S.EnergyStrategy #U.S.OilReserve

https://www.europesays.com/1887586/ Petroleum Economist: March 2025 #CrudeOil #CrudeOilPrice #GasMarket #Oil&Gas #OilMarket #OilPrice #petroleum

NNPCL Reduces Petrol Price to N860 Per Litre Amid Market Competition: The Nigerian National Petroleum Company Limited (NNPCL) has announced a reduction in Premium Motor Spirit (PMS) pump price, commonly known as petrol, to N860 per litre, effective Monday. This adjustment comes amid increasing competition among oil marketers and independent petroleum dealers and fluctuations in global crude oil prices. The new price… https://creebhills.com/2025/03/nnpcl-reduces-petrol-price?utm_source=dlvr.it&utm_medium=mastodon #PetrolPrice #NNPCL #Nigeria #FuelPrice #OilMarket

https://www.europesays.com/1879067/ OPEC+ Rethinking Oil Production Rampup After Trump Complications #CrudeOil #CrudeOilPrice #oil #OilMarket #OilPrice #OilPrices #opec #OutputCuts #petroleum #Russia #SaudiArabia #Shale

https://www.europesays.com/1864085/ “Dark ships” are moving sanctioned oil around the globe #CrudeOil #CrudeOilPrice #OilMarket #OilPrice #petroleum #ShippingIndustry

https://www.europesays.com/1849889/ BPCL secures a strategic contract with Petrobras for Brazilian crude oil imports #CommercialRelations #CrudeOil #CrudeOilPrice #OilImport #OilMarket #OilPrice #petroleum

US Treasury Secretary Yellen aims to slash Iran's oil exports to under 10% of current levels, citing concerns over terrorism funding and emphasizing sanctions enforcement.

#YonhapInfomax #IranOilExports #USTreasury #JanetYellen #Sanctions #OilMarket #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=50948

https://www.europesays.com/?p=1836312 Iran Says Trump’s Maximum Pressure Will Fail to Drive Its Oil Exports to Zero #CrudeOil #CrudeOilPrice #diplomacy #failure #geopolitics #Iran #MaximumPressure #OilExports #OilMarket #OilPrice #petroleum #Résistance #sanctions #US

https://www.europesays.com/1836007/ Petroleum Economist: February 2025 #CrudeOil #CrudeOilPrice #GasMarket #Oil&Gas #OilMarket #OilPrice #petroleum

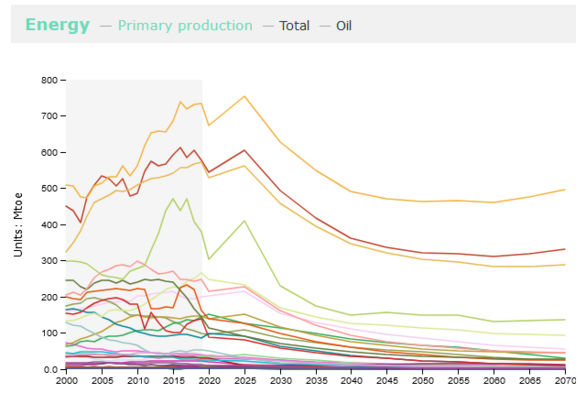

"Drill, baby, drill"? What for? Looks like the #oilmarket is saturated and demand will be decreasing. Yes, it's #PeakOil demand, thanks to #electrification and #ClimateChange policies. According to @Grist: "The Gulf [of Mexico] accounts for 97 percent of all offshore oil and gas production in the U.S. Nearly 12 million acres are under active leases in the Gulf, but only about 2.4 million acres are being used to produce oil and gas"

https://grist.org/energy/trump-wants-more-drilling-but-the-oil-market-is-already-saturated/

Graph from the #JRCGECO report.

https://www.europesays.com/1818967/ OPEC Drops U.S. EIA as a Secondary Source Assessing Oil Production #Compliance #CrudeOil #CrudeOilPrice #DataSource #EIA #JMMCMeeting #OilMarket #OilPrice #opec #petroleum #production #SecondarySources #U.S.

Marketers Consider Dropping Dangote Fuel as Imported Petrol Hits N922/Litre: Oil marketers have revealed that the landing cost of Premium Motor Spirit (petrol) as of Friday was N922.65 per litre. Dealers said this cost factors in various expenses, including shipping, import duties, and exchange rates. This is a considerable reduction of N32.35 from the N955 per litre offered at the Dangote Petroleum… https://creebhills.com/2025/01/marketers-consider-dropping-dangote-fuel-as-imported-petrol-hits-n922-litre?utm_source=dlvr.it&utm_medium=mastodon #PetrolPrices #DangoteFuel #NigeriaEconomy #OilMarket #FuelCost

WTI Crude Oil Weekly Outlook

WTI Crude Oil may see higher prices again, but caution is needed. Recent downward momentum suggests speculators are losing strength. A drop below $74 could push prices to $73 quickly. While some upside potential remains, U.S. energy policy shifts indicate possible declines ahead. Speculators should take profits and avoid excessive selling, as price reversals are likely. Resistance above $75.50 may signal overvaluation.

#OilMarket #finance #Speculation

Speculators should manage risk and consider taking profits.

#OilMarket #WTI #TradingStrategy #MarketTrends #RiskManagement

The IEA has lowered its oil demand growth forecast for the third consecutive month due to a significant drop in Chinese consumption. The revised estimate predicts an increase of 862,000 bpd this year, down from 903,000 bpd. For 2025, the forecast sees demand rising to 103.8M bpd, with China expected to contribute only 20% to global gains, a stark decline from nearly 70% last year. OPEC’s forecast remains more optimistic, predicting a growth of 1.93M bpd this year.#OilDemand #IEA #OilMarket

Oil prices spike amid Middle East tensions. Investors are on edge over potential supply disruptions from Iran, while markets await US jobs data.

What do you think about this geopolitical impact on markets? $WTI $BRENT #OilMarket #Isreal #Gaza #Iran #Missiles

WTI Crude Oil Update

WTI Crude Oil is under downward pressure but finding support at $65. As long as it stays above this level, there's potential for a rebound. However, concerns about growth are making traders cautious. Expect continued volatility as prices stabilize near recent lows.